Tiller And YNAB: A Comparison of Two Popular Budgeting Tools

Personal budgeting is a fundamental aspect of prudent money management. It’s a handy tool for

Personal budgeting is a fundamental aspect of prudent money management. It’s a handy tool for budgeting your money, keeping tabs on your spending habits, laying away money for the future, and overall bettering your financial status. But if you have to manually record and label every single transaction you make, budgeting may be a major pain.

Therefore, many people apply budgeting software to simplify and automate their money management. You may design and maintain tabs on your budget with the aid of budgeting software, which links to your bank accounts and inserts your transactions there. Financial analysis, goal-setting, and the application of both triumphs and failures are all made simpler by the tools they give.

Tiller and YNAB (You Need A Budget) are two of the most well-known budgeting software out there right now. Both offer a service that helps you keep track of your money by automatically importing your financial transactions and categorising them into a uniform database. There are, though, substantial disparities between them in terms of usefulness, pricing, and overall impression. This essay will help you pick between Tiller vs YNAB by offering a full comparison of the two software.

Tiller Overview

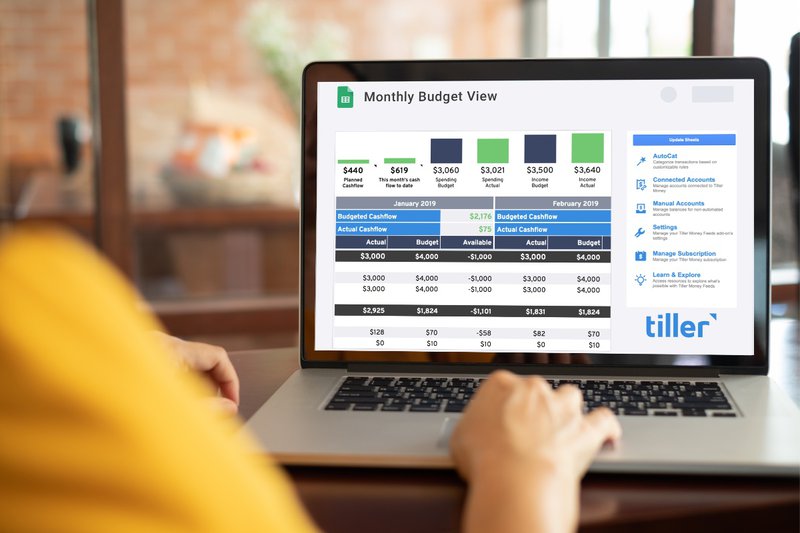

Tiller is a financial planning app that syncs with your bank accounts to automatically input transactions into spreadsheets like Google Sheets or Microsoft Excel. Spreadsheets may be used as the basis for your budget, offering you more leeway and possibilities than with other budgeting tools.

Tiller’s primary characteristics and advantages include:

- Spreadsheets that are adaptable to your needs and preferences, letting you create your own charts, graphs, and algorithms to better track your finances. To make a spreadsheet that fits your specific requirements, you can either start from scratch or use one of the many available templates and add-ons.

- Financial planning spreadsheets, apps, and other tools to manage your money and achieve your financial objectives. Community-developed themes and plugins may be downloaded for even more flexibility and power.

- In-depth financial analysis, scenario planning, and decision-making support enabled by state-of-the-art planning and forecasting instruments. Financial planning tools like retirement savings calculators, tax estimaters, and debt snowball programmes may all be made using Tiller.

- Spreadsheets may be shared and edited in real-time by several users. Share your budget spreadsheet with your significant other, partner, family members, or financial experts so that everyone can access and make adjustments as needed.

- Prices are less expensive than YNAB’s ($79 yearly vs. $99 yearly or $14.99 monthly). Tiller offers prospective users a free, 30-day trial period before they must commit to a paid membership.

YNAB Overview

You Need A Budget (YNAB) is a cloud-based budgeting system that syncs with your bank accounts and automatically imports your transactions. Following the four budgeting concepts of “giving every dollar a job,” “accepting your true expenses,” “rolling with the punches,” and “ageing your money,” it leads you via a straightforward and easy-to-understand interface.

Among YNAB’s many features and advantages are:

- Make every dollar count, accept your actual costs, learn to adapt, and let your savings mature. Following these guidelines will allow you to better prepare for irregular or unexpected costs, make necessary adjustments to your budget, and save up a safety net.

- The ability to define savings goals is a great tool for preparing for unexpected expenses, future travel plans, or major expenditures. You may monitor your progress towards monthly or deadline-based budget category targets.

- An in-depth reporting function that details your income, expenses, savings, and debt repayment over specified time intervals. Your spending patterns may be compared to those of other YNAB users or to your own historical results.

- Access your accounts, monitor your spending, and generate reports from anywhere with this mobile app that syncs with the online version. The mobile app also allows you to scan receipts and associate them with previous purchases.

- Helpful people and informative materials that may guide you towards better personal finance management. You can talk to other people who use YNAB on the forum, watch video lessons, read blog entries, or listen to podcasts.

Tiller vs YNAB Comparison

Now that you know what Tiller and YNAB are and how they function, you can compare the two using the following criteria:

Budgeting Style

Tiller and YNAB’s approaches to budgeting are fundamentally different. While YNAB is tailored towards zero-based budgeting, Tiller can accommodate any method of financial planning.

- When compared to other budgeting applications, Tiller’s adaptability and customisation come from its support for using spreadsheets as the foundation for budgeting. To make a spreadsheet that fits your specific requirements, you can either start from scratch or use one of the many available templates and add-ons. Budgeting strategies like the envelope system, the 50/30/20 rule, and “pay yourself first” are just a few examples.

- But YNAB uses a technique called zero-based budgeting, which is strictly adhered to. This implies that you allocate each and every one of your hard-earned dollars to a particular purpose in your budget, such as housing, food, transportation, entertainment, savings, etc. Your monthly budget should be balanced by ensuring that your revenue is equal to or greater than your spending. By doing so, you may control your expenditure, build savings, and achieve your objectives.

Customization

Another important contrast between Tiller and YNAB is that Tiller allows for more customization. Tiller has more configuration possibilities than YNAB when it comes to setting up categories, rules, formulas, reports, etc.

- Tiller is a spreadsheet programme that lets you customise your financial documents to your liking. You may change your current classifications whichever you choose. You may also create your own rules and formulas to automate or simplify your budgeting processes even more. If you want to reward customers for spending beyond a specific amount, you may create a rule that does just that. You may easily create a formula to track your net worth, debt-to-income ratio, savings rate, or any other monetary metric you care about.

- YNAB’s budgeting approach, on the other hand, is more set in stone. While the basic categories (including “current responsibilities,” “real costs,” “debt payments,” etc.) are fixed in place and cannot be moved or removed, secondary categories are customizable. No rules or formulae you come up with may be used to change the information in your budget or on your transactions. The “four rules of budgeting” laid forth by You Need a Budget (YNAB) should be used as a guide when arranging and managing your money.

Functionality

Tiller’s functionality is different from that of YNAB. When compared to YNAB, which is primarily concerned with budgeting and goal-setting, Tiller goes above and above by also providing additional tools for planning and forecasting.

- Tiller gives you extra tools to maximise your financial choices and prepare for the future. Financial planning tools like retirement savings calculators, tax estimaters, and debt snowball programmes may all be made using Tiller. Community-developed themes and plugins may be downloaded for even more flexibility and power.

- YNAB’s primary focus is on assisting you in developing and maintaining a practical budget in order to realise your financial objectives. By using YNAB, you may establish and monitor monthly or yearly targets for each budget area. You may see reports that break out your income, expenses, savings, and debt repayment by category and time frame.

User Experience

Another area where Tiller and YNAB diverge is in the quality of the user interface. Tiller’s manual input and emphasis on spreadsheet expertise sets it apart from YNAB, whose interface is more intuitive and automated.

- Tiller is best suited to those who already have a solid grasp of spreadsheet-based budgeting. You’ll have greater leeway to format your budget sheet as you see fit. However, this calls for more proficiency with spreadsheets and further manual input on your part. You’ll need to properly prepare your spreadsheet, input or modify your transactions, develop or modify your formulae and rules, etc.

- If you’d rather use an app to manage your finances, YNAB is made for you. It has a user-friendly design that is based on the “four budgeting rules.” It also helps you save time by automating a lot of the work. It imports your transactions and automatically assigns categories to them (though you can always change this if necessary), calculates your budget amounts based on your objectives and historical spending trends, notifies you if you go over or under your budget, etc.

Mobile Access

- Tiller’s mobile availability is an additional point of differentiation from YNAB. Unlike YNAB, which has a fully working mobile app, Tiller does not have a native mobile app. There is currently no Tiller app for either iOS or Android. While the mobile versions of Google Sheets and Microsoft Excel will allow you to see your budget spreadsheet on the go, they may not provide quite the same level of convenience as a specialised app. Some of the Tiller templates and plugins may not work with your installation or have other compatibility concerns.

- YNAB’s online app works in tandem with a native mobile app for both iOS and Android. You may use the app while you’re on the move to record purchases, monitor your spending, and see reports. The mobile app also allows you to scan receipts and associate them with previous purchases. The mobile app is almost feature- and function-complete with the web app; the online app is the only place to get more complex settings or choices.

Conclusion

Tiller and You Need a Budget (YNAB) are two of the most well-known budgeting programmes out there right now. Both provide a service that helps you keep track of your finances by automatically importing your financial transactions and classifying them into a unified database. There are, nevertheless, notable distinctions between them in terms of functionality, cost, and overall impression. Here, we’ve laid out the key differences between Tiller and YNAB to help you choose the one that’ll work best for you.

Tiller and YNAB have been contrasted with respect to their respective budgeting methodologies, functionality, user interface, and mobile availability. While YNAB guides you through a proven and reliable approach, Tiller gives you more room to personalise your budget spreadsheet. Our investigation revealed that Tiller offers more tools for planning and forecasting, whereas YNAB focuses on goal-setting and reporting. Compared to Tiller, which requires more familiarity with spreadsheets and manual data input, we found that YNAB had a more user-friendly and automated interface. Finally, we found out that although YNAB’s mobile app works perfectly, Tiller’s does not.

You Can Also Read Here Cash Advance for Merchant Blursoft: MCA Can Help You Finance Your Business